Boost Your Credit with Aqua Classic Credit Card: A Comprehensive Review

Explore the Perks, Fees, and Mobile Management Features for Poor Credit UK

Boost Your Credit with Aqua Classic Credit Card: A Comprehensive Review

Explore the Perks, Fees, and Mobile Management Features for Poor Credit UK

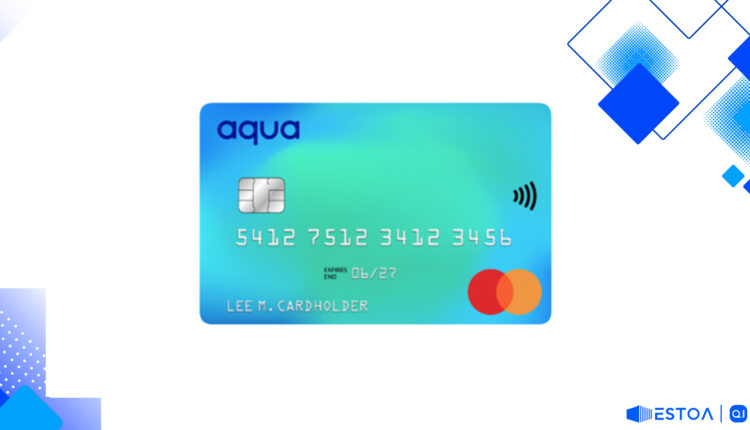

Are you struggling with poor credit and looking for a way to improve your score? The Aqua Classic credit card might just be the answer to your financial woes. Crafted for individuals in the UK with less-than-perfect credit, the Aqua Classic offers a plethora of features designed to help you build a better credit profile. Dive into this comprehensive review to discover how this credit card can be a game-changer for you.

Aqua Classic Credit Card Overview

The Aqua Classic credit card is tailored for those with poor credit, making it an excellent tool for anyone keen on rebuilding their credit score. This card is accessible to individuals who haven't had a County Court Judgment (CCJ) in the past 12 months or declared bankruptcy in the past 18 months. Whether you're starting fresh or recovering from financial setbacks, the Aqua Classic credit card opens doors to a more secure financial future.

Key Features and Benefits

Understanding the main features can help you decide if the Aqua Classic is the right card for you:

- Best for: Individuals looking for a straightforward card with a robust mobile app for easy management.

- Introductory offers: None.

- Representative APR: 34.90% variable.

- Fees: Zero annual fee.

- Perks: Access to the Aqua Coach feature, aiding in credit score improvement.

Manage Aqua Classic Card Online

Managing your Aqua Classic card is a breeze, thanks to its top-notch mobile app. The app allows you to keep track of your spending, set up text alerts, and make payments effortlessly. This feature ensures that you stay on top of your payments, helping you avoid late fees and potential damage to your credit score.

Aqua Classic Mobile App Benefits

The Aqua Classic card stands out with its user-friendly mobile app, making life considerably easier for cardholders. Benefits of using the app include:

- Instant notifications: Receive real-time updates on transactions and balance changes.

- Payment reminders: Set up alerts to avoid missing payments.

- Easy access: Manage your account from anywhere, anytime.

- Spending insights: Get a detailed breakdown of your spending patterns.

Improve Credit Score with Aqua Card

Using the Aqua Classic responsibly can help improve your credit score over time. By making timely payments and keeping your balance low, you gradually build a positive credit history. The Aqua Coach feature provides personalized tips and advice to help you make smarter financial decisions, further enhancing your credit-building journey.

Aqua Credit Card: No Annual Fee

One of the standout features of the Aqua Classic credit card is that it comes with no annual fee. This means you can enjoy all the benefits of the card without worrying about an additional yearly charge, making it cost-effective for those looking to rebuild their credit.

Aqua Classic APR: Know the Costs

The representative APR for the Aqua Classic is 34.90% variable, which is higher than what's typically found on credit cards aimed at individuals with better credit scores. However, the lack of annual fees and the 48-day interest-free period for those who pay off their balance in full each month can offset this higher rate.

Interest-Free Period

If you pay off your balance in full within 48 days, you can take advantage of an interest-free period. This feature is highly beneficial for those who manage their finances well, helping you avoid interest charges and maintain a healthy credit score.

Keep reading to discover essential tips on how to maximize your Aqua Classic card benefits.

How to Apply for the Aqua Classic Credit Card

Aqua provides an online eligibility checker that allows you to see if you are likely to be approved for the Aqua Classic card without impacting your credit score. Simply fill out a few basic details to get a clear picture of your eligibility.

How to Pay Off Aqua Classic Balance

Paying off your Aqua Classic balance in full every month is crucial for avoiding interest charges and further enhancing your credit score. The mobile app makes this process convenient by offering payment reminders and easy access to your account details.

Aqua Coach Feature

The Aqua Coach feature is an invaluable tool for those looking to improve their credit score. It offers personalized advice and tips, guiding you on how to make smarter financial decisions. This feature is especially useful for individuals new to credit cards or those recovering from financial difficulties.

Fees and Costs of the Aqua Classic Card

While the Aqua Classic has no annual fee, it's essential to be aware of other costs associated with the card:

- APR: 34.90% variable.

- Cash transaction fee: 5% of the transaction amount.

- Late payment fee: Applicable if payments are not made on time.

Aqua Classic Limit Review

The initial credit limit on the Aqua Classic card ranges from £250 to £1200, depending on your credit status. Although the maximum limit is relatively low, responsible use of the card can lead to potential limit increases over time.

Aqua Card Alternatives UK

If you're not entirely convinced that the Aqua Classic is the right fit, consider these alternatives:

- Marbles credit card: Similar to Aqua Classic, aimed at those with poor credit.

- Capital One Classic credit card: Another excellent option for building credit.

- Tesco Foundation credit card: Offers rewards and is another viable choice for individuals with poor credit.

Marbles vs Aqua Classic

When comparing Marbles to the Aqua Classic, both cards offer similar benefits for those with poor credit. However, the Marbles card may have slightly different APR rates and perks, so it's worth comparing the two to see which aligns better with your needs.

Capital One Classic vs Aqua Classic

The Capital One Classic card also targets individuals with poor credit, offering competitive APR rates and easy management tools. Comparing it with the Aqua Classic can help you determine which card provides the features you value most.

Tesco Foundation vs Aqua Classic

The Tesco Foundation credit card offers rewards that could be appealing if you frequently shop at Tesco. Though it shares similarities with the Aqua Classic, the rewards program might make it a better option for some.

In conclusion, the Aqua Classic credit card offers a host of benefits for individuals looking to rebuild their credit. With its user-friendly mobile app, no annual fee, and various features aimed at improving your credit score, it's a solid choice for those with poor credit. Use the online eligibility checker to see if you qualify and start your journey towards better financial health today.

Aqua Classic Credit Card Perks: More Than Just Credit Building

Taking full advantage of the Aqua Classic credit card involves more than just improving your credit score. Cardholders can benefit from additional perks designed to make managing finances easier. For instance, the Aqua Classic offers a 24/7 customer service line, ensuring you can get help whenever needed. Furthermore, detailed monthly statements help you track your spending and monitor financial health effectively. The card also includes robust fraud protection measures, offering peace of mind that your finances are secure. By utilizing these additional features, you not only improve your credit score but also gain greater control over your financial life.

Responsible Use and Financial Discipline

Using the Aqua Classic credit card responsibly is crucial for maximizing its benefits. Make it a habit to pay off your balance in full every month. This practice helps avoid high-interest charges and ensures you make the most of the 48-day interest-free period. Set a budget for your expenditures and use the mobile app to track your spending. Adhering to these practices can pave the way for potential credit limit increases, offering more financial flexibility over time. Remember, the key to financial success with the Aqua Classic card lies in disciplined spending and regular payments.

Whether You Need Aqua Classic or Something Different

While the Aqua Classic credit card offers numerous benefits for those with poor credit, it might not be the perfect fit for everyone. If you're searching for a card with different features, consider alternatives like the Marbles credit card, Capital One Classic, or Tesco Foundation credit card. Each of these offers unique benefits tailored to different financial needs. Curious to know which card might suit you better? Explore our in-depth comparison reviews and discover the ideal card for your financial journey. Unveil a card option that might just surprise you with its unique offerings and find out how it could better align with your financial objectives.