Venmo Credit Card: Earn Personalized Cashback Effortlessly

The Best Cashback Credit Card with No Annual Fee and Unique Venmo Rewards

## Venmo Credit Card: Earn Personalized Cashback Effortlessly

Welcome to the future of personalized cashback rewards with the Venmo Credit Card. As one of the best cashback credit cards in the market, the Venmo Credit Card stands out with its unique features tailored for Venmo users. Issued by Synchrony Bank, this card elevates your spending experience by offering customization and ease, making it a top contender among credit cards with no annual fee. Let's delve deeper into what makes this card a must-have.

Understanding the Venmo Credit Card Rewards

The Venmo Credit Card takes the guesswork out of earning rewards. Unlike traditional cards that require you to track and activate bonus categories, this card automatically adjusts its cashback rates based on your spending. Every month, you can earn up to 3% cashback on your top spending category, 2% on your second-highest, and 1% on all other purchases. This intelligent categorization ensures you always get the most out of your expenses.

Here's a glimpse of what you can expect:

- 3% Cashback: Highest-spending category (e.g., travel or groceries)

- 2% Cashback: Second-highest category (e.g., dining or transportation)

- 1% Cashback: All other purchases

This seamless reward structure prioritizes your spending habits, making it the best cashback credit card for those looking for an easy way to earn.

Venmo Credit Card Perks and Benefits

The perks of the Venmo Credit Card are numerous and tailored for modern users:

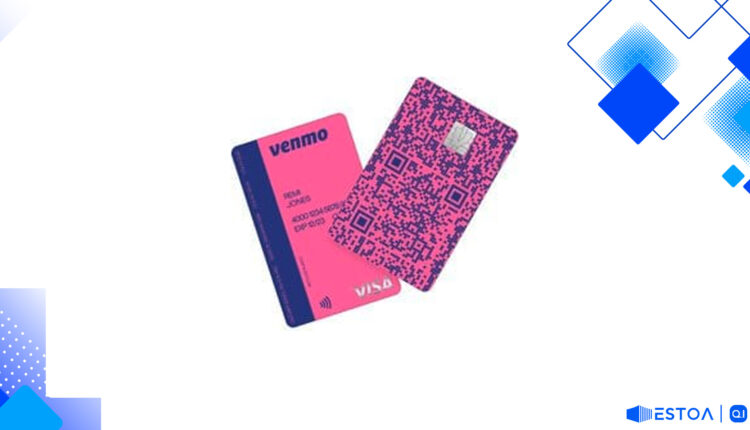

Personalized QR Code: Each card comes with a unique QR code, making splitting costs a breeze. Friends can scan your code to access your Venmo profile, facilitating quick payments.

Instant Access: Once you're approved, you can start using your virtual card immediately through the Venmo app. Your physical card with your personalized QR code will follow shortly.

Manage Everything on the App: The Venmo app is your hub for all card-related activities. From checking transaction details to managing rewards, everything is conveniently located within the app.

Crypto Rewards: Venmo allows you to convert your cashback into cryptocurrency without additional transaction fees. However, be aware of the conversion spread.

The Venmo Credit Card offers an intuitive and personalized user experience, making it a prime choice for those already familiar with the Venmo ecosystem.

Pros and Cons at a Glance

| Pros | Cons | | — | — | | No annual fee | No 0% intro APR | | Personalized cashback rates | Requires good/excellent credit | | Instant access upon approval | Limited spending categories for 3% and 2% cashback |

The table above provides a clear overview of the Venmo Credit Card's strengths and weaknesses, simplifying your decision-making process.

How To Apply for the Venmo Credit Card

Applying for the Venmo Credit Card is straightforward but does come with a few prerequisites:

- Venmo Account: Ensure you've had an active Venmo account for at least 30 days.

- Open the Venmo App: Navigate to the Venmo Credit Card section within the app.

- Submit Your Application: Enter the required information and await approval.

Upon approval, you can instantly add the virtual card to your digital wallet and start earning cashback.

Venmo Credit Card Fees and APR

Understanding the costs associated with the Venmo Credit Card is crucial:

Annual Fee: None

APR:

- Regular APR between 15.24% – 24.24% Variable

- Cash Advance APR at 24.24% Variable

Foreign Transaction Fees: None

These competitive rates make the Venmo Credit Card an attractive option for cost-conscious consumers.

Venmo Credit Requirements and Alternatives

To qualify for the Venmo Credit Card, you typically need good to excellent credit, defined as a FICO score of 690 or above. If you fall short of this requirement, consider alternatives like secured credit cards or other cashback cards with lenient credit requirements.

Comparing Venmo Credit Card with Other Options

It's always wise to compare your choices:

- Citi Double Cash® Card: Offers 2% cashback on all purchases.

- Discover it® Cash Back: Features rotating 5% cashback categories.

- Chase Freedom Unlimited®: Combines 1.5% unlimited cashback with a 0% intro APR on purchases.

Each of these cards brings unique benefits, making it essential to assess what aligns best with your financial goals.

Final Thoughts: Is the Venmo Credit Card Right for You?

If you're a frequent Venmo user seeking a hassle-free cashback experience, the Venmo Credit Card is an excellent match. Its personalized rewards, no annual fee, and seamless integration with the Venmo app make it a compelling choice. However, if you prioritize lucrative sign-up bonuses or have less than stellar credit, exploring other credit card options might be beneficial.

Elevate your spending and simplify cost-sharing with the Venmo Credit Card – a modern solution for personalized cashback rewards.

By leveraging the unique features and benefits of the Venmo Credit Card, you can maximize your rewards effortlessly. Consider your spending habits and financial needs to determine if this card aligns with your lifestyle, and start enjoying the personalized perks it offers.

Managing Venmo Card Rewards Efficiently

Maximizing your Venmo Credit Card rewards involves a bit of strategic planning. One of the most efficient ways Venmo users can manage their cashback rewards is through the Venmo app itself. The app has an intuitive interface that allows you to track your spending across different categories and observe how your cashback accumulates. Ensuring you regularly check these categories can help you tailor your spending to optimize higher cashback rates. For example, if you notice that dining is your highest category this month, plan your big purchases around that. This habit ensures you are always getting the maximum rewards available. The Venmo app's analysis tools can keep you informed, making reward management straightforward and user-friendly. It's all about spending smartly and allowing the card's dynamic rewards to work in your favor.

Using Your Venmo Reward Points Wisely

Once you've started accumulating cashback rewards with your Venmo Credit Card, it's essential to know how to use them wisely. One beneficial option is converting your rewards into cryptocurrency, which Venmo offers directly through their platform. This can be a valuable opportunity for those interested in the growing crypto market. Alternatively, your cashback can be transferred back to your Venmo balance, allowing you to use it for everyday expenses, splitting bills with friends, or making purchases. This versatility makes the Venmo Credit Card not only a tool for earning rewards but also a flexible financial instrument to manage your budget. Evaluating your financial goals and aligning them with your reward points will help you leverage the full potential of the Venmo Credit Card's benefits.

Crafting a Long-Term Strategy with Venmo Credit Card

The Venmo Credit Card is more than just a short-term cashback tool; it can be a central part of your long-term financial strategy. Given its no annual fee feature and the customizable cashback categories, this card offers sustainable value over time. Planning your major expenses around high cashback categories can result in significant savings. Additionally, by maintaining good credit habits with the Venmo Credit Card, such as paying your bill in full each month and monitoring your spending, you can also improve your credit score over time. This, in turn, opens doors to better credit offers and financial products in the future. As you consider options for cash back, don't overlook the larger picture—how incorporating the Venmo Credit Card into your broader financial strategy can yield long-term rewards and improved financial health.

Ready for a totally different credit card experience that could complement your financial strategy even further? Discover another versatile solution that might just surprise you.