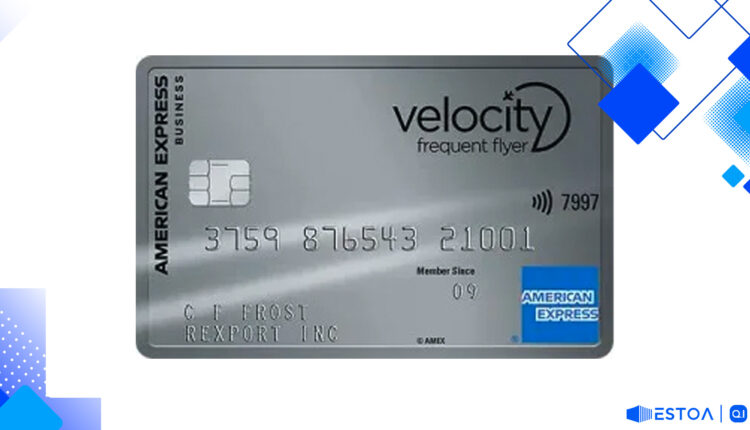

Maximize Business Rewards with American Express Velocity Business Card

100,000 Bonus Velocity Points, Virgin Australia Lounge Access, and More for a $249 Annual Fee

Maximize Business Rewards with American Express Velocity Business Card

Unlock business rewards, earn Velocity Points, and enjoy exclusive perks with the American Express Velocity Business Card. With a competitive annual fee and a suite of benefits, this card could be the perfect fit for your business spending needs.

The American Express Velocity Business Card rewards new card members with 100,000 bonus Velocity Points, two complimentary Virgin Australia lounge passes annually, and no pre-set spending limit, making it an attractive option for small and medium-sized enterprises (SMEs). To qualify for the 100,000 bonus Velocity Points, apply by 27 August 2024 and spend $3,000 within the first two months of card approval. These points can be redeemed for a variety of rewards, including flights with Virgin Australia.

Earning Velocity Points

This Amex business card allows you to earn up to 2 Velocity Points per $1 spent on eligible purchases, including ATO payments. The points earned can be used for various rewards, such as business-class flight redemptions, making it a valuable tool for companies looking to maximize their travel budget.

Key Highlights:

- Earn 100,000 bonus Velocity Points for new card members

- Receive up to 2 Velocity Points per $1 spent on eligible purchases

- Enjoy 2 Virgin Australia lounge passes annually

- Benefit from no pre-set spending limit and automatic feeds for MYOB, Microsoft Excel, and Quicken

Card Benefits and Features

In addition to the generous points program, the American Express Velocity Business Card offers numerous benefits to enhance your business travel experience. The card comes with complimentary domestic and overseas travel insurance, adding peace of mind for your corporate journeys.

Pros:

- 100,000 bonus Velocity Points offer

- Up to 2 Velocity Points per $1 spent

- Complimentary Virgin Australia lounge passes

- Complimentary 12-month Velocity Frequent Flyer Gold Membership

Cons:

- $249 annual fee

- $99 annual fee for each additional employee card

- 3% foreign transaction fee

The $249 annual fee is competitive, considering the extensive benefits and rewards offered. Employee cards come with a $99 annual fee each, which may be worth considering for companies with multiple cardholders.

How to Apply

Applying for the American Express Velocity Business Card is a straightforward process that can be completed online within minutes. Ensure you meet the eligibility criteria, such as having a business revenue of at least $75,000 annually and not holding an American Express card in the past 18 months, to enjoy the introductory offer.

Eligibility Criteria:

- Business revenue must be $75,000 or more annually

- Applicant must be a new Amex card member (not held any Amex card in the last 18 months)

- Must meet personal credit requirements

Rewards and Points Redemption

The Velocity Frequent Flyer program provides extensive redemption options, from flights and upgrades with Virgin Australia to retail gift cards and more. With uncapped rewards points, your business can continue to earn and redeem without limitations.

Value of Velocity Points:

- One-way business class flight from Sydney to Los Angeles: 95,500 points

- Domestic flights and upgrades

- Various retail and lifestyle redemptions

Fees and Rates

Understanding the costs associated with the card is crucial. The American Express Velocity Business Card charges an annual fee of $249, and each additional cardholder incurs a fee of $99 per annum. Foreign transactions attract a 3% fee, which is essential to consider if your business conducts international transactions regularly.

Summary of Fees:

- Annual fee: $249

- Additional cardholder fee: $99 per card

- Foreign transaction fee: 3%

- Interest-free period: Up to 51 days on purchases

Card Value vs. Costs

When weighing the card's value against its costs, consider the potential for earning Velocity Points, the travel perks, and the insurance benefits. These features can offset the annual fees, especially for businesses with significant travel and spending needs.

Additional Benefits

The American Express Velocity Business Card also includes automatic feeds for business software applications such as MYOB, Microsoft Excel, and Quicken. This feature simplifies financial management and expense tracking, saving valuable time and effort for your finance team.

Travel Insurance Benefits:

- Complimentary domestic travel insurance

- Overseas travel insurance coverage

- Protection for various business trips and journeys

Employee Card Options

For companies with multiple employees needing card access, the American Express Velocity Business Card offers the option to add up to 99 additional cardholders for a fee of $99 each per year. This feature ensures seamless expense management across your team while earning Velocity Points on all eligible spending.

Conclusion

The American Express Velocity Business Card is a compelling choice for businesses aiming to maximize rewards from their spending. With the ability to earn substantial Velocity Points, enjoy travel perks, and benefit from comprehensive insurance coverage, this card stands out in the market. Ensure it aligns with your business needs, taking into account the fees and eligibility criteria, to fully leverage its benefits. Maximizing the value of the American Express Velocity Business Card doesn't stop at points and lounge passes. The complimentary insurance coverages provided by this card can be a game-changer for business travel. Domestic and overseas travel insurance benefits include coverage for lost or delayed luggage, trip cancellations, and medical emergencies, providing peace of mind on both local and international trips. Business trips entail myriad unpredictable elements, and having insurance as robust as what's offered by this card ensures that such contingencies do not disrupt your operations. Moreover, the insurance covers not just the cardholder but also employee cardholders, thus extending the safety net across your entire team.

Another significant advantage is the automatic feeds for business software applications like MYOB, Microsoft Excel, and Quicken. This feature simplifies tracking expenses, generating financial reports, and optimizing resource allocation. Imagine the efficiency gained by eliminating manual data entry and reducing the risk of human error. The seamless integration into these commonly used applications makes financial tracking almost effortless. This is particularly useful for businesses looking to streamline their accounting processes and maintain accurate financial records with minimal effort. The convenience of automatic data feeding cannot be overstated, as it saves considerable time and ensures that you always have up-to-date, accurate financial information at your fingertips.

One notably unique benefit is the ATO payments card feature, allowing businesses to earn Velocity Points on tax payments, a rarity among business rewards cards. This feature enables companies to maximize their rewards potential for expenses that are non-negotiable and often sizable. By earning points on tax payments, your business can accelerate its pace towards earning valuable rewards, such as business class flight rewards or other redemption options under the Velocity Frequent Flyer program. As your business meets its fiscal obligations, it simultaneously accumulates benefits that can be reinvested into furthering business growth and employee satisfaction through travel upgrades and other perks. To explore an entirely different type of card with unique benefits, discover an option that could redefine your business spending strategy and needs.