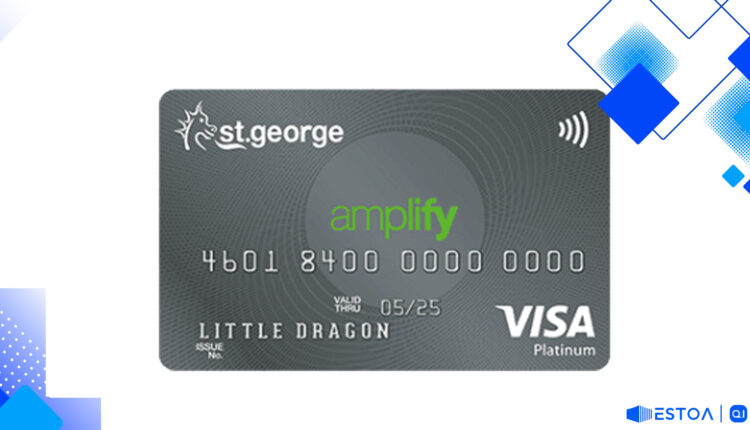

Revealing the St.George Amplify Platinum Credit Card: 100,000 Bonus Points & No Annual Fee First Year

Rewards Credit Card with 0% Balance Transfer Offer, Velocity Points, and Comprehensive Travel Insurance

# Unveil the St.George Amplify Platinum Credit Card: 100,000 Bonus Points & No Annual Fee First Year

Ready to make the most out of your spending habits while enjoying a multitude of benefits? The St.George Amplify Platinum Credit Card just might be the companion you need. This rewards credit card sets itself apart with generous bonus points, impressive balance transfer offers, and diverse travel insurance options—all designed to enhance your financial journey.

St.George Amplify Platinum Credit Card Overview

Designed with savvy spenders in mind, the St.George Amplify Platinum Credit Card is one of the best credit cards in Australia for those focused on accumulating rewards. You'll earn 1 point per $1 spent on eligible purchases and get 100,000 bonus Amplify Points if you apply as a new cardholder and spend $3,000 within the first 90 days. These points are highly versatile, allowing for various redemptions—from flights to eGift cards.

Key Features and Benefits

100,000 Bonus Amplify Points

New cardholders who meet the spending threshold can earn a whopping 100,000 bonus Amplify Points. For instance, you could convert these into 50,000 Velocity Frequent Flyer points, enough for a return flight from Sydney to Denpasar. Alternatively, redeem up to $450 worth of eGift cards. Uncapped rewards mean there's no limit on the points you can earn on eligible purchases.

Annual Fee

For the first year, enjoy a discounted annual fee of $49. Afterward, the fee increases to $124, making it still competitive compared to other top rewards cards.

Balance Transfer Offer

Got existing credit card debt? The 0% balance transfer offer allows you to transfer your balance without interest for 24 months. Note that there's a one-off 1% balance transfer fee. During this period, you'll need to make minimum monthly payments to keep the offer valid. Be mindful of repaying your balance in full each month to avoid being hit by the high 21.49% p.a. cash advance rate after the offer period ends.

No Annual Fee for the First Year

In addition to the discounted fee, new cardholders can enjoy the first year with no annual fee, making it easier to maximise the card’s advantages upfront without extra cost.

Travel Benefits and Insurance Coverage

One of the card's standout features is its travel insurance. Travel smarter with complimentary travel insurance, covering scenarios like medical emergencies, travel cancellation, and lost luggage. This makes the card especially appealing for frequent travellers.

How to Apply for the St.George Amplify Platinum Credit Card

Applying for this credit card is straightforward. Fill out the online application, providing essential details such as identification and financial information. Make sure you meet the minimum income requirement and have a good credit score to increase your chances of approval.

Pros and Cons of St.George Amplify Platinum Credit Card

| Pros | Cons | | — | — | | 100,000 Bonus Amplify Points | 1% Balance Transfer Fee | | $49 Annual Fee in the First Year | 21.49% p.a. Cash Advance Rate Post-Offer | | 0% p.a. for 24 Months on Balance Transfers | 3% Foreign Transaction Fee | | Uncapped Rewards Points | | | Comprehensive Travel Insurance | |

Pros Explained

- Bonus Points: The 100,000 bonus Amplify Points offer is a remarkable benefit for new cardholders who meet the spending criteria.

- Annual Fee Waiver: The $49 annual fee in the first year lets you use the card without a significant upfront expense.

- No Interest Balance Transfer: Paying 0% p.a. on balance transfers for 24 months is a financial advantage for those needing debt relief.

- Uncapped Rewards: No limits on the points you can earn on eligible purchases.

- Travel Insurance: Comprehensive coverage for travellers, adding immense value.

Cons Explained

- Balance Transfer Fee: A 1% balance transfer fee applies, which can slightly reduce the benefits of transferring your balance.

- High Cash Advance Rate: Any remaining balance after the transfer period will incur a 21.49% p.a. fee, which is quite high.

- Foreign Transaction Fee: The 3% fee on foreign transactions may deter international spenders.

Redeeming St.George Amplify Points

The St.George Amplify Platinum Credit Card provides numerous ways to redeem your accumulated points. Conversion into Velocity Frequent Flyer points, shopping vouchers, and more makes it a flexible option for cardholders aiming to maximise rewards. You can start redeeming rewards from just 3,000 points.

Ongoing Costs and Fees

While the card offers various benefits, it’s important to be mindful of ongoing costs and fees. After the first year, the annual fee jumps to $124. Furthermore, carrying a balance beyond the balance transfer period can result in high-interest rates, making it crucial to manage payments effectively.

Conclusion

With rich features, substantial bonus points, and comprehensive travel insurance, the St.George Amplify Platinum Credit Card stands out as a top credit card in Australia. While understanding the associated costs is essential, the rewards and benefits can significantly outweigh them when used wisely. Get ready to transform your spending habits and earn rewards like never before with the St.George Amplify Platinum Credit Card.

Maximising Your Rewards Experience

To make the most of your St.George Amplify Platinum Credit Card, it’s essential to strategically plan your spending. Timing your purchases to qualify for promotions and bonuses can significantly amplify your rewards. For instance, many retailers offer double points or special seasonal promotions, making it an ideal time to use your card. Additionally, everyday expenses such as groceries, fuel, and utility bills can also count towards accumulating points. Strategic spending not only maximises your rewards but also ensures you're gaining the most value from your credit card. So why settle for less when you can unlock more with smart usage?

Comparison with Other Top Rewards Credit Cards

When considering a rewards credit card, comparing options is crucial. The St.George Amplify Platinum Credit Card stands strong among its competitors, thanks to its extensive features and benefits. However, it's important to examine other top rewards cards in Australia to determine the best fit for your lifestyle and financial goals. Some cards may offer higher bonus points but might lack in other areas, such as travel insurance or uncapped rewards. By comparing the St.George Amplify Platinum with other cards, you can ensure you're selecting the best credit card that aligns with your needs. Remember, a well-informed choice today can lead to substantial rewards tomorrow.

The Bigger Picture: Financial Responsibility and Benefits

While the allure of rewards points and travel benefits is enticing, it's paramount to approach credit card usage with financial prudence. Regularly paying off balances prevents accruing high interest, which can negate the card's perks. Moreover, monitoring your spending habits and assessing the relevance of rewards to your lifestyle ensures you’re truly benefiting from the card. It’s also wise to review the terms and conditions periodically, as credit card offers and benefits can change. Embracing responsible credit card management not only secures the rewards but also fosters better financial health. Curious about how this card compares to another intriguing option with unique perks? Discover an alternative that might just exceed your expectations and elevate your financial strategy.