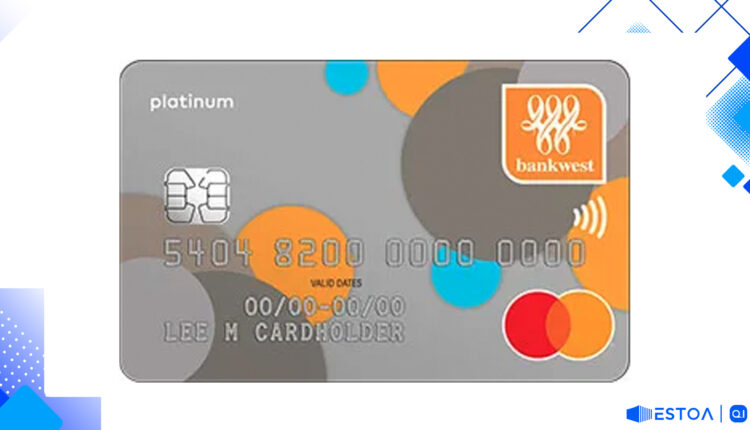

Review of Bankwest Zero Platinum Mastercard: An Exceptional No Annual Fee Credit Card in Australia

Valuable Features of a Platinum Card for Australian Travellers

Finder makes money from featured partners, but editorial opinions are our own. Advertiser disclosure 🏆

Bankwest Zero Platinum Mastercard Review: The Ultimate No Annual Fee Credit Card in Australia

Unveil the Best Platinum Card for Travelers with 0% Balance Transfer and Complimentary Travel Insurance

The Bankwest Zero Platinum Mastercard stands out as a top choice among Australians looking for the perfect blend of cost-efficiency and powerful travel benefits. If you're in search of a no annual fee credit card in Australia that offers 0% p.a. on balance transfers and complimentary travel insurance, you're in the right place. This review will uncover all the intriguing features of this award-winning credit card, leaving you convinced that it’s the best pick for savvy travelers.

The Bankwest Zero Platinum Mastercard offers an attractive package with no annual fees ever, coupled with a 0% p.a. balance transfer rate for 28 months—though you should be aware of the 3% balance transfer fee. This combination could be a financial lifesaver, particularly for those looking to consolidate debts. With this card, not only do you dodge the annual fees, but you also get the opportunity to manage your debts without the additional burden of high-interest rates.

Key Benefits and Features

No Annual Fee and Foreign Transaction Fees

One of the standout features of the Bankwest Zero Platinum Mastercard is its everlasting zero annual fee. This is a significant advantage for cardholders who wish to avoid recurrent charges while enjoying premium benefits. Furthermore, the card eliminates foreign transaction fees, making it an ideal companion for international travelers who prefer not to be penalized for spending abroad.

Complimentary Travel Insurance Credit Card

Travelers will benefit immensely from the complimentary overseas travel insurance that comes with this card. Whether you’re planning a short holiday or a long-term trip, this feature offers substantial savings and peace of mind knowing that you are covered against common travel mishaps.

Low-Interest Platinum Card

Despite being a no annual fee, platinum card, the Bankwest Zero Platinum Mastercard features a relatively low purchase interest rate of 14.99% p.a. This low rate is an added bonus that usually comes with cards that have annual fees, making this card exceptionally cost-effective.

Mobile Payments and Digital Card Feature

In today’s digital age, having a card compatible with mobile payments is crucial. The Bankwest Zero Platinum Mastercard supports Apple Pay, Samsung Pay, and Google Pay, enabling seamless transactions through your smartphone. Moreover, the card offers a digital card feature, which means you can start using it instantly via the app even before your physical card arrives. This feature is particularly beneficial for those who require immediate access to their credit line.

Pros and Cons

Every credit card has its pros and cons, and the Bankwest Zero Platinum Mastercard is no exception. Here's a quick glance at what makes this card tick and areas where it might not meet your needs:

| Pros | Cons | |——|——| | $0 annual fee | 3% balance transfer fee | | No foreign transaction fees | Modest rewards program | | Complimentary Travel Insurance | No frequent flyer points | | Digital card access | Travel insurance terms apply | | 14.99% p.a. purchase rate | Limited premium features |

How to Apply for the Bankwest Zero Platinum Mastercard

Applying for the Bankwest Zero Platinum Mastercard is a straightforward process that you can complete online:

- Eligibility: Ensure you meet the eligibility criteria, which include being at least 18 years old and having a good credit score.

- Documents: Provide necessary documents including proof of identity and financial details.

- Submit Application: Fill out the online application form with your personal and financial information.

- Approval: Once approved, you’ll get instant access to the digital card feature while you await the physical card’s arrival.

Costs and Fees

While the Bankwest Zero Platinum Mastercard boasts no annual fee, it’s important to note the other associated costs:

- Balance Transfer Fee: 3% of the transferred amount

- Purchase Rate: 14.99% p.a.

- Cash Advance Rate: Higher APR typically applies, ranging around 21.99% p.a.

- Late Payment Fee: A fixed fee for missed payment deadlines

The absence of annual and foreign transaction fees makes this card particularly appealing for those looking to minimize their costs.

Award-Winning Features

The Bankwest Zero Platinum Mastercard has gained recognition and accolades for its all-round performance and customer focus. It has received numerous awards, highlighting its excellence in providing value to its customers without compromising on essential features.

Best Credit Card for Travelers in Australia

Combining zero annual fees, no foreign transaction fees, complimentary travel insurance, and mobile payment compatibility, the Bankwest Zero Platinum Mastercard positions itself as the best credit card for travelers in Australia. It delivers optimal financial solutions for those who frequently find themselves on the road, both domestically and internationally.

Conclusion

In summary, the Bankwest Zero Platinum Mastercard is an excellent choice for anyone looking for a comprehensive, cost-effective credit card. With its robust selection of features, lack of annual fees, and travel-centric benefits, it’s hard to overlook the benefits this card brings to the table. Whether you're aiming to manage debt through balance transfers or seeking a reliable companion for your travels, this card has got you covered.

So, is the Bankwest Zero Platinum Mastercard your next wallet essential? Given its extensive advantages, it certainly makes a strong case. Apply today and start enjoying unparalleled financial freedom and travel security. The Bankwest Zero Platinum Mastercard continues to demonstrate its superiority in the world of platinum credit cards, particularly for frequent travelers. Its array of features is designed to cater to a wide variety of financial needs without the burden of annual fees. Moreover, the 0% p.a. balance transfer for 28 months is a significant advantage for those who are looking to consolidate and manage their debts efficiently. Unlike many other cards that promise low-interest rates but come with hidden fees, this card maintains transparency, ensuring users are always informed and can plan their finances accordingly.

Another compelling aspect of the Bankwest Zero Platinum Mastercard is its user-friendly nature when it comes to digital payments. With the increasing reliance on smartphones and digital wallets, the card's compatibility with Apple Pay, Samsung Pay, and Google Pay provides unparalleled convenience. The instant digital card feature is particularly noteworthy as it allows immediate access to credit, eliminating the waiting period typically associated with physical cards. This feature is especially beneficial in emergencies or for those spontaneous purchases that cannot wait. This seamless integration with mobile payments ensures users are never left in a lurch, enhancing the overall cardholder experience.

While the pros significantly outweigh the cons, it’s important to acknowledge the areas where the Bankwest Zero Platinum Mastercard could improve. For instance, the 3% balance transfer fee, though nominal, may deter some users looking for a completely fee-free experience. Additionally, the absence of a frequent flyer points program might be a disadvantage for those who prioritize earning travel rewards. However, the complimentary travel insurance, which covers a range of mishaps, does make up for this shortfall to a great extent. The card strikes a balance between offering extensive travel benefits and maintaining cost efficiency, making it a well-rounded choice for a diverse group of users.

If you’re intrigued by the versatility and benefits of the Bankwest Zero Platinum Mastercard, there’s another card option you should be aware of—one that a multitude of users also find compelling for very different reasons. Want to discover how it stacks up against other top cards in Australia and whether it might be a better fit for your unique financial needs? Explore further to uncover this alternative and make an informed decision that could redefine your understanding of credit card benefits and features.