Harnessing the Power of the Amex Cobalt Card in Canada

Unveiling Top Amex Cobalt Card Benefits, Rewards, and Fees for Canadian Users

## Discover the Power of the Amex Cobalt Card in Canada

Unveiling Top Amex Cobalt Card Benefits, Rewards, and Fees for Canadian Users

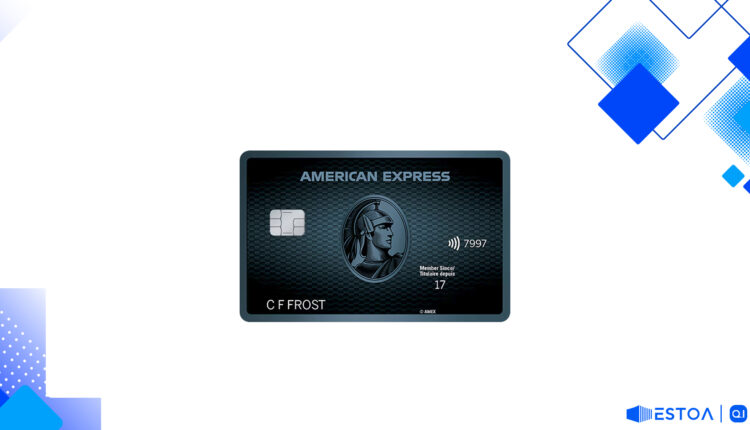

Are you looking for a credit card with exceptional rewards and unmatched perks in Canada? The Amex Cobalt Card might be your best bet, offering an array of benefits that cater perfectly to your lifestyle and spending habits. Welcome to our in-depth Amex Cobalt review Canada, where we dissect everything you need to know about one of the best credit cards in Canada.

The Amex Cobalt Card has rapidly ascended the ranks of top travel credit cards in Canada, positioning itself as a powerhouse in the realm of credit card rewards Canada. From its compelling welcome bonus to its flexible points system, this credit card has a lot to offer, making it an attractive option for Canadians. Read on to discover why the Amex Cobalt Card is considered a frontrunner among the best credit cards for dining and more.

Amex Cobalt Welcome Bonus

One of the standout features of the Amex Cobalt Card is its generous welcome bonus. New cardholders can earn a substantial amount of points within the first few months of usage, giving you a head start on accumulating valuable credit card points Canada. These points can be redeemed in various intriguing ways, including travel, dining, and statement credits, offering a level of flexibility that few other cards can match.

Intrigued? Let’s delve deeper into why this card is so sought after.

Amex Cobalt Perks: What's on Offer?

The Amex Cobalt Card is brimming with perks that can elevate your everyday spending. First and foremost, the card provides significant rewards for dining and groceries, making it a preferred choice for frequent diners and families alike. Here are some of the core benefits:

Enhanced Earn Rates:

- 5 points for every $1 spent on eligible dining and grocery purchases in Canada.

- 2 points for every $1 spent on travel, transit, and gas.

- 1 point for every $1 spent on everything else.

Comprehensive Travel Insurance:

- Includes travel medical insurance, trip interruption, and rental car insurance, ensuring peace of mind during your journeys.

Monthly Bonus Points:

Earn additional points each month by spending a minimum amount, allowing cardholders to maximize their earnings continuously.

Such robust framework makes this a top contender among cashback credit cards Canada.

How to Use Amex Cobalt Points

The versatility of Amex Cobalt points is truly impressive. Points can be transferred to several airline and hotel loyalty programs, giving you the flexibility to tailor your rewards to your personal travel preferences. Alternatively, you can use points for statement credits or purchases through the American Express Canada portal. Ample flexibility in points redemption.

Interested in extracting maximum value from your points? Keep reading!

Amex Cobalt Card Fees

While the perks are undeniable, it is essential to consider the associated fees. The Amex Cobalt Card charges a monthly fee instead of an annual fee, which can make it easier to manage. The monthly fee is competitive with other top Amex cards Canada. Here are the key fees to be aware of:

- Monthly Fee: $12.99

- Additional Card Fee: $0 for the first additional card, $12.99 per month for subsequent cards

- Foreign Transaction Fee: 2.5%

Though some might find the foreign transaction fee a setback, the card’s rewards can easily offset these charges, especially if you leverage the card's benefits effectively.

Applying for Amex Cobalt

The application process for the Amex Cobalt Card is straightforward, making it accessible even for those new to credit cards. Applicants need to meet the basic criteria, including being the age of majority in your residing province or territory and having a good credit score. The approval process is relatively quick, allowing you to start enjoying your Amex Cobalt Card perks sooner than you might expect.

By now, you must be keen on how this card stacks up against its competitors. Let's explore that next.

Amex Cobalt vs Competitors

In the competitive landscape of credit cards, the Amex Cobalt Card stands out primarily due to its high reward rates and versatile points redemption options. When comparing the Amex Cobalt Card to other offerings, it's clear why it is a favorite for many:

- Against Cashback Cards: While some cards offer flat cashback rates, the Amex Cobalt provides higher rewards rates on specific categories like dining and groceries, making it more lucrative for strategic spenders.

- Compared to Travel Cards: The Amex Cobalt excels with its flexible points that can be transferred to various travel partners, unlike some travel cards which lock you into a specific loyalty program.

- Versus Low-Interest Cards: Although the interest rates on purchases are not the lowest, the rewards and perks often justify the costs, especially for those who pay off their balances monthly.

This balance of features and rewards makes it a strong contender in the realm of the best credit cards Canada.

The Pros and Cons of the Amex Cobalt Card

To help you make an informed decision, here is a quick summary of the pros and cons of the Amex Cobalt Card:

| Pros | Cons | |——————————————–|————————————| | High reward rates on dining and groceries | Monthly fee can add up | | Flexible points redemption options | Foreign transaction fee of 2.5% | | Comprehensive travel insurance | Requires good credit score | | Generous welcome bonus | |

When weighing these pros and cons, it is evident that the card provides excellent value, particularly for those who spend heavily in the high-reward categories.

How to Maximize Amex Cobalt Benefits

For cardholders looking to maximize benefits, it is crucial to align your spending with the card's reward categories. Utilize the card for all dining and grocery purchases to accrue the highest points, and take advantage of the monthly spending thresholds to earn bonus points. Additionally, plan your travel and large purchases to coincide with point redemption options for optimal value.

Conclusion

The Amex Cobalt Card is undoubtedly one of the best credit cards available in Canada, with a well-rounded offering of benefits tailored to meet diverse spending needs. From impressive rewards on dining and groceries to flexible points redemption and comprehensive travel insurance, this card has it all. By understanding and leveraging its features, you can unlock significant value and enjoy a superior credit card experience.

Whether you’re looking to maximize your everyday purchases or seeking robust travel rewards, the Amex Cobalt Card stands out as a premier choice among credit card rewards Canada. If you’re in the market for a new credit card, applying for Amex Cobalt might just be the step you need to elevate your financial game.

Don’t miss the opportunity to make the most of your spending.

Amex Cobalt Grocery Rewards

Beyond dining, the Amex Cobalt Card offers solid incentives for grocery shopping, making it a strong contender among grocery rewards credit cards Canada. By earning 5 points for every dollar spent on eligible grocery purchases, cardholders can accumulate points quickly on everyday essentials. This is particularly appealing for families and individuals who spend a significant portion of their budget on groceries. The rewards from grocery purchases can add up fast, turning a routine expense into an opportunity for significant savings or travel opportunities.

Furthermore, the card’s broad acceptance at major grocery chains in Canada means you won’t have to alter your shopping habits to maximize rewards. It's an effortless way to make your grocery spending work harder for you. The combination of high reward rates for dining and groceries underlines the card’s suitability for a wide range of lifestyles, ensuring that you get the most out of your everyday expenses.

Travel Benefits and Insurance

For those who travel frequently, the Amex Cobalt Card offers a suite of travel benefits and insurance that enhance its value. From travel medical insurance to trip interruption and rental car coverage, the card ensures you are well-protected during your travels. The insurance coverage is comprehensive, providing peace of mind whether you're embarking on a domestic trip or an international adventure.

The card also offers access to exclusive travel deals and experiences through the American Express Travel portal. Cardholders can redeem their points for flights, hotels, and other travel-related expenses, providing flexibility and convenience. The ability to transfer points to airline and hotel loyalty programs amplifies the card's appeal for avid travelers. By leveraging these travel benefits, you can not only protect yourself and your loved ones but also enrich your travel experiences, making the Amex Cobalt Card a valuable companion on your journeys.

Customer Experience and Support

Having a reliable card issuer is crucial, and American Express Canada excels in customer service. Cardholders frequently commend the responsive and helpful support provided by Amex. Whether it's resolving issues or answering queries about card benefits, the dedicated customer service team ensures a smooth and satisfactory experience.

Additionally, the American Express mobile app and online portal are user-friendly, allowing cardholders to manage their accounts effortlessly. From tracking your spending to redeeming rewards, the app provides all the tools you need to stay on top of your finances. The user-centric design and robust security measures enhance the overall customer experience, making Amex Cobalt Card ownership a hassle-free affair.

When it comes to customer care and support, American Express truly stands out, further solidifying the Amex Cobalt Card's position among the best credit cards in Canada. Ready to discover another exceptional credit card option? Prepare to be intrigued by an alternative that offers a completely different set of benefits and features.