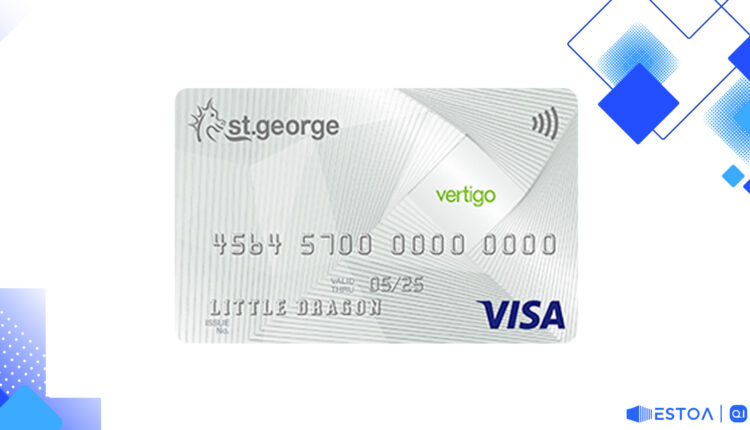

A Comprehensive Guide to the St.George Vertigo Card in Australia

Navigate through Australia’s credit card landscape with the low-rate St.George Vertigo Card

With the multitude of credit cards available in Australia, making a choice can feel like navigating through a minefield. Have you considered the St.George Vertigo Card? This low-rate card offers attractive benefits like a lengthy interest-free period and competitive purchase rate, perfect for managing your finances effectively.

The St.George Vertigo Card is not your typical credit card. It doesn’t try to woo you with points, rewards, or travel perks. Instead, it offers 0% interest on balance transfers for up to 28 months, a feature rarely seen in the credit card market. With a low annual fee, it’s a suitable option for individuals aiming to minimise payment costs.

For every financial action, there’s an appropriate credit card, and this low-rate card could just be your perfect match if your focus is on interest-free balance transfers and low fees. And with the St.George Vertigo Card, you’re also furnished with the assurance of a trusted banking institution. But how does this credit card truly stand out among its counterparts?

Balance Transfer Benefits

Achieving financial stability requires strategic money management. This includes dealing with existing credit card debt. With the St.George Vertigo Card, you can transfer your old credit card debt and enjoy 0% interest for 28 months. This is the longest interest-free balance transfer offer currently on the market, which could give you ample time to pay off your debt.

Remember, however, that there’s a one-time 1% balance transfer fee. But considering the interest costs you stand to save, this could be a small price to pay.

The Convenience of Interest-free Purchases

Beyond the balance transfer benefits, the card also provides an interest-free period of up to 55 days on new purchases. This can help keep your purchase costs low if you’re disciplined with repayments. Please note, though, that to take full advantage of this feature, it’s best to hold off on new purchases until your transferred balance is fully paid.

Let’s delve into the financials. The card has a competitively low purchase rate of 13.99% p.a. To paint a clearer picture, that’s 6.08% lower than the average standard credit card interest rate.

Ease of Application and Eligibility

The credit card application process can sometimes feel complex and tedious. Thankfully, with the St.George Vertigo Card, the process is smooth and easy. In just 10 minutes, you can complete the online application and receive an instant response.

The key eligibility criteria include being a new cardholder and a resident of Australia. If you’re keen on the balance transfer offer, remember that your balance transfer debt should come from a card not issued by St.George, Bank of Melbourne or BankSA.

Additional Perks

Even though the low rate card from St.George is basic, it doesn’t skimp on additional benefits. For instance, there’s no cost to get an additional cardholder. This is a boon if you want a secondary card for a family member.

Mobile payments are another area where the St.George Vertigo Card earns its stripes. The card is compatible with digital wallets, including Apple Pay, Google Pay, and Samsung Pay, making tap and go payments a breeze.

Despite its few drawbacks, the St.George Vertigo Card proves to be a strong contender in the credit card field, competing on the merits of a low-interest rate, an appealing balance transfer offer, and fewer fees. Consider your financial goals, do the maths, and test it out. Could the St.George Vertigo Card be your ideal financial companion in the credit card space?

Customer Service Assistance

The St.George Vertigo Card is not just famed for its financial benefits. It’s also reputed for its quality customer service assistance. It provides 24/7 customer support, which ensures that you can contact them anytime you need assistance. This ease of access is an added comfort for cardholders, who can rest assured that they can get help whenever they need it.

Points to Consider

While the St.George Vertigo Card certainly offers a multitude of benefits, it’s essential to take note of some caveats. As much as the card offers an extended interest-free period for balance transfers, it’s important to plan to pay off your balance within those 28 months. After this period, any remaining balance transfers will revert to a variable cash advance rate which stands at 21.49% p.a.

Online Security Features

The St. George Vertigo Card also offers robust online security features. Fraud Money Back Guarantee guarantees peace of mind with monetary compensation in case of fraudulent charges. Secure online banking also ensures that your credentials, transactions, and other sensitive data are safe from potential breaches.