PrimeBank Visa Infinite: Elite Nigerian Credit Card for High Net Worth Individuals

Understanding the Features and Global Usability of High Limit Credit Cards

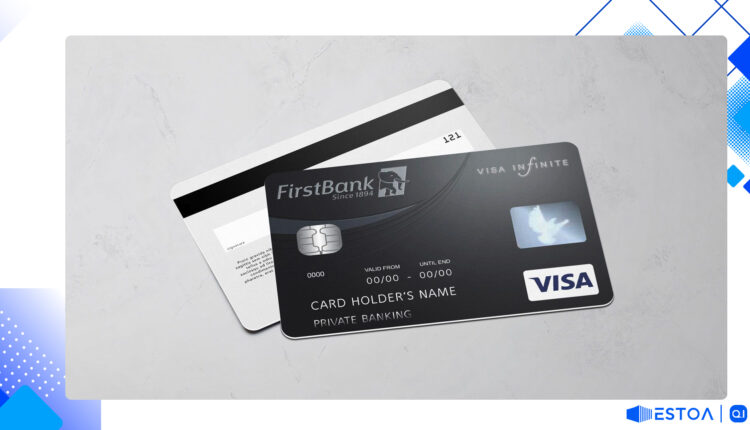

# The FirstBank Visa Infinite: Ultimate Nigerian Credit Card for High Net Worth Individuals

Explore Premium Benefits and International Use with the Best High Limit Credit Card in Nigeria.

Are you part of Nigeria's affluent elite seeking a credit card that matches your high net worth status? The FirstBank Visa Infinite could be the ideal choice for you. This premium card offers more than just a high credit limit—it provides an array of luxurious perks and global privileges designed for the discerning individual.

Key Features of the FirstBank Visa Infinite

The FirstBank Visa Infinite stands out in Nigeria's market of premium credit cards. Targeted at the top 1% to 5% of FirstBank's customers, the card offers a default credit limit starting at $15,000, with the possibility of a higher limit upon request. The billing cycle is 30 days, and the maximum facility tenor is 36 months. One notable feature is that 120% of the credit limit must be collateralized, held in USD, GBP, or EUR fixed deposit accounts.

Features at a Glance:

- Default credit limit: $15,000 minimum

- Maximum facility tenor of 36 months

- 30-day billing cycle

- Collateral requirement: 120% of credit limit

- Minimum operating balance: $100

Premium Benefits Associated with the Visa Infinite

This high limit credit card in Nigeria provides unparalleled benefits tailored to meet the needs of high net worth individuals. Cardholders gain access to unique privileges such as international concierge services, premium insurance, and guaranteed transaction success rates globally. The card also offers an interest-free period of up to 45 days, flexible repayment options, and emergency services like cash advances and card replacements.

Highlighted Benefits:

- Exclusive travel, dining, shopping, and lifestyle opportunities

- International concierge and premium insurance services

- Guaranteed acceptance across all channels

- Up to 45 days interest-free period

- Flexible repayment terms

How to Apply for the Visa Infinite Card

Applying for the FirstBank Visa Infinite Card is straightforward but exclusive, as it is offered by invitation only. After receiving the invitation, applicants should visit any FirstBank branch to fill out an application form. Your investment in this card promises a blend of convenience and luxury.

Cost and Fees Involved

While the benefits are high, the associated fees remain relatively low, making it a leading credit card with low fees in Nigeria. The annual membership fee is $200, with supplementary card and maintenance fees amounting to $10. Other charges include a 3% flat interest fee on the outstanding balance and a nominal fee for card replacement and ATM withdrawals.

Cost Breakdown:

- Card Joining/Reissuance Fee: $3

- Supplementary card fee: $3

- Main Card Annual Maintenance Fee: $10

- Annual Membership fee: $200

- Interest Fees: 3% flat (Outstanding balance)

- ATM Withdrawal Fee: $5 per transaction

Target Market for the Visa Infinite Card

The FirstBank Visa Infinite is a Nigerian credit card for high net worth individuals, specifically targeted at owners and managing directors of large organizations and ultra-high net worth individuals.

Target Market Includes:

- Owners/MDs of organizations and conglomerates

- High Net Worth Individuals

- Ultra-high net worth individuals

Daily Usage Limits and Services

The card supports high transactional limits, allowing ATM cash withdrawals up to $1,000 daily and purchases up to $25,000. This is ideal for executives and individuals who require substantial financial flexibility.

Daily Usage Limits:

- ATM cash withdrawals – $1,000

- Purchases (POS) – $25,000

- Purchases (Internet) – $25,000

Emergency Services and Additional Features

One of the standout features of the FirstBank Visa Infinite is its suite of emergency services. The card provides emergency cash advances through MoneyGram or Western Union and can replace a lost or stolen card swiftly.

Emergency Services:

- Emergency card replacement

- Emergency cash advance via MoneyGram or Western Union

Conclusion

In summary, the FirstBank Visa Infinite card stands out as the best Nigerian credit card for those who demand luxury and flexibility. It combines high credit limits, international emergency services, and premium lifestyle benefits, tailored for high net worth and ultra-high net worth individuals. Whether you are looking for an executive credit card with extensive features or a travel credit card that offers unique privileges globally, the FirstBank Visa Infinite meets all these needs and more. Visit a FirstBank branch to embark on your journey towards owning this impeccable card. Invite-only applicants can look forward to an elite financial experience, unmatched by any other card in Nigeria.

Additional Travel Benefits for Global Explorers

For frequent travelers, the FirstBank Visa Infinite offers a suite of travel-focused benefits designed to enhance your journeys. With priority access to over 1,000 airport lounges worldwide and exclusive discounts on flights and hotel bookings, this card ensures you travel in luxury. The travel insurance coverage is comprehensive, providing peace of mind whether you are traveling for business or leisure. Additionally, the Visa Infinite Concierge is available 24/7 to assist with travel arrangements, restaurant reservations, and even personal shopping requests, making every trip seamless and enjoyable.

Travel Companion Perks:

- Access to global airport lounges

- Exclusive flight and hotel discounts

- Comprehensive travel insurance coverage

- 24/7 Visa Infinite Concierge services

Financial Security and Fraud Protection

The FirstBank Visa Infinite card also places a strong emphasis on security. Equipped with advanced EMV chip technology and supported by Verified by Visa, this card ensures that your transactions are safe and secure. Moreover, cardholders benefit from fraud protection services that monitor and alert you of any suspicious activities, adding an extra layer of security. Should you lose your card or it gets stolen, the emergency card replacement service ensures minimal disruption. Financial security is paramount, and the FirstBank Visa Infinite card offers robust measures to protect your wealth.

Security Features:

- EMV chip technology

- Verified by Visa support

- Fraud monitoring and alerts

- Swift emergency card replacement

Exclusive Lifestyle Privileges

Living a high-end lifestyle is simplified with the FirstBank Visa Infinite card. The card offers unmatched privileges in dining, shopping, and entertainment. You can enjoy exclusive access to top golf courses, luxury resorts, and VIP events. Additionally, the card provides significant cashback rewards and discounts at select merchants, allowing you to save while you spend. These features are tailored to fit the needs of high net worth individuals who seek the finest things in life. From fine dining reservations to personal shopping assistants, the FirstBank Visa Infinite card lets you enjoy the best that life has to offer.

Lifestyle Rewards:

- Access to premium golf courses and resorts

- VIP event invitations and concierge services

- Cashback rewards and merchant discounts

- Personalized dining and shopping experiences

Are you curious about an alternative credit card that offers unique benefits and caters to a different audience? Discover another exceptional option that may better suit your needs.