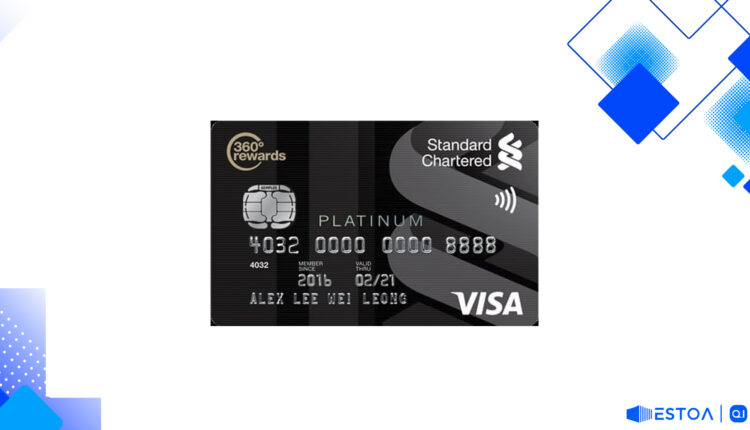

Visa Platinum Credit Card: Elite Privileges Await in Nigeria

Unlock the Best Credit Card Benefits with Nigeria Visa Platinum

Unlock a whole new dimension of financial freedom and elite privileges with the Visa Platinum Credit Card in Nigeria. Packed with exclusive benefits and high credit limits, this card offers unparalleled rewards and seamless international usage, making it one of the best credit cards available in Nigeria.

Elite Benefits of the Visa Platinum Credit Card

The Visa Platinum Credit Card offers several noteworthy benefits that make it stand out. These include:

- Supplementary Cards: You can enjoy up to five supplementary cards for your loved ones, which means your family can also benefit from your primary card’s privileges.

- Global Acceptance: This card is accepted by over 23 million merchants globally, including online platforms.

- Cashback Rewards: Enjoy 5% cashback on all dining expenses, which can be significant savings each month.

High Credit Limit for Greater Freedom

With the Visa Platinum Credit Card, you can enjoy substantially higher credit limits compared to Gold cardholders. This allows for significant financial flexibility, whether for everyday expenses or larger purchases.

Flexible Repayment Options

One of the standout features of the Visa Platinum Credit Card is the flexibility it offers in repayments. Repayments can be made using local currency (NGN) either through cash or cheque at branches. The card also allows for minimum monthly repayments as low as 1% of the total spend or ₦5,000, whichever is higher. This ensures you are not overwhelmed by hefty payment demands each month.

Interest-Free Credit Period

The card offers up to 45 days of interest-free credit, allowing you the freedom to manage your expenditures better without accruing extra costs.

Easy Online and Mobile Banking Payments

Managing payments is seamless, thanks to the robust online and mobile banking platforms. Settle your credit card bills through Internet banking, mobile banking, or set up standing instructions for automatic debits from your bank account.

Stay Alert with Fraud Protection

The Visa Platinum Credit Card comes with a built-in fraud alert system to notify you of any unusual or suspicious activity. This added layer of security ensures that your financial information remains safe and secure.

Purchase Protection and Extended Warranty

Your purchases are insured against loss, damage, theft, or breakage for the first 90 days up to $1,500 per item. Additionally, it offers an extended warranty for 12 months after purchase, further safeguarding your investments.

Eligibility Criteria and How to Apply

To be eligible for the Visa Platinum Credit Card, applicants must be Nigerian residents aged 21 years or older. The minimum credit limit starts at ₦750,000, with a maximum limit of ₦7.2 million. Applicants need to have a minimum salary of ₦120,000. You can apply online or by visiting any of the branches.

Pros and Cons Table

| | Pros | Cons | |—————————|———————————————|——————————————-| | High Credit Limit | Allows for significant financial freedom | | | Cashback Rewards | 5% cashback on dining | Monthly interest on POS & online payments | | Global Acceptance | Accepted by over 23 million merchants | ₦5,000 minimum monthly repayment | | Purchase Protection | Insured against loss/damage for 90 days | |

Costs and Benefits

Understanding the costs and benefits is crucial to making the most out of your Visa Platinum Credit Card:

- Interest Rate: Monthly interest is 3% for POS or online transactions, but can be waived if paid before the due date.

- Cash Withdrawals: A 4% interest fee applies from the date of withdrawal until fully settled. Cash withdrawals via ATMs do not qualify for the interest-free period.

- Credit Limit Increase: Eligible if the card is active for at least six months with satisfactory usage and credit behavior.

International Usage

This credit card is open for international spend, with a maximum spend limit of $1,000 per 30 days for Platinum cardholders. However, online transactions for foreign sites need to be enabled upon request.

SCB Mobile Banking Payments

Utilize SCB Mobile Banking for hassle-free management of payments, monitoring transactions, and staying updated with your spending.

Supplementary Credit Cards in Nigeria

A primary cardholder can request up to five supplementary cards. The limit of these supplementary cards is determined by the primary cardholder but will be a part of the primary card’s maximum limit. Moreover, rewards points from qualifying spends on all linked cards can be combined or kept separate as preferred.

Extended Warranty for Peace of Mind

An extended warranty for an additional 12 months after purchase provides added protection for your high-value items, ensuring they remain functional and protected beyond the usual warranty period.

SCB Credit Card Fraud Alert System

Stay secure with real-time fraud alerts that notify you of any suspicious activities on your credit card. This built-in security feature ensures your financial information remains protected at all times.

Conclusion

The Visa Platinum Credit Card offers a plethora of elite privileges, making it one of the best credit cards in Nigeria. From high credit limits to attractive cashback offers and robust fraud protection, this card caters to a wide range of financial needs while providing peace of mind with its comprehensive benefits and security features. Whether for dining, travel, or everyday expenses, the Visa Platinum Credit Card is an excellent choice for discerning individuals looking to maximize their financial potential.

Unlock these exclusive benefits and more by applying for your Visa Platinum Credit Card today. Enjoy the freedom, security, and rewards that come with one of the best credit cards available in Nigeria.

Extended Travel Benefits with SCB Visa Platinum

When it comes to travel, the Visa Platinum Credit Card truly shines. Cardholders enjoy a suite of travel benefits, including complimentary travel insurance, airport lounge access, and global assistance services. This is crucial for frequent travelers as it provides peace of mind and added comfort during trips. The travel insurance covers medical emergencies, trip cancellations, lost luggage, and more, making sure you are well-protected wherever your adventures take you. The airport lounge access allows you to relax before your flights in exclusive lounges worldwide, transforming your travel experience into a luxurious journey.

Additionally, the global assistance services offer round-the-clock support for emergencies, such as lost passports or emergency cash advances, ensuring you're never stranded in a foreign country without help. Whether you're traveling for business or leisure, these benefits make the Visa Platinum Credit Card a valuable companion. By combining these extensive travel perks with the robust fraud protection system, you can travel worry-free, knowing that both your financial and personal well-being are looked after comprehensively.

Rewards and Redeemable Points for Every Spend

The rewards program associated with the Visa Platinum Credit Card is especially generous. Cardholders earn points for every Naira spent, whether on local expenditures or international transactions. These points can be redeemed for a variety of options, including travel miles, merchandise, and even statement credits. What's more, the points you accumulate don't expire, giving you the flexibility to redeem them at your convenience. The program's structure ensures you're always getting something back for your spending, making it easier to justify those larger purchases or spur-of-the-moment expenses.

The high earning rate on certain categories like dining, travel, and online shopping means that frequent users can quickly amass significant rewards. This extensive rewards system, combined with the card's high credit limit, offers unparalleled financial flexibility and makes everyday transactions far more rewarding. For those who thrive on maximizing their benefits, the Visa Platinum Credit Card's rewards program is an ideal fit. It enhances your purchasing power while allowing you to enjoy the perks that come with every swipe.

Comprehensive Customer Support and Service

Customer support is a cornerstone of the Visa Platinum Credit Card experience. Cardholders have access to dedicated customer service teams available around the clock, ensuring that any issues or concerns are promptly addressed. Whether you need assistance with transactions, reporting a lost card, or inquiring about your rewards points, the customer service teams are trained to provide quick and effective solutions. This commitment to customer support extends to personalized financial advice and tailored services that can help you make the most of your credit card benefits.

Furthermore, the Visa Platinum Credit Card also offers concierge services to assist with a variety of tasks, from booking travel itineraries to making restaurant reservations. This level of personal service elevates the card beyond just a financial tool, transforming it into a lifestyle enhancer. The comprehensive customer support and concierge services mean you are never alone in managing your financial affairs, providing you with the confidence and security to focus on what truly matters—living your best life.

Interested in exploring a totally different type of credit card that offers unique features and benefits? Discover what else is out there and unlock new opportunities with another exceptional option.