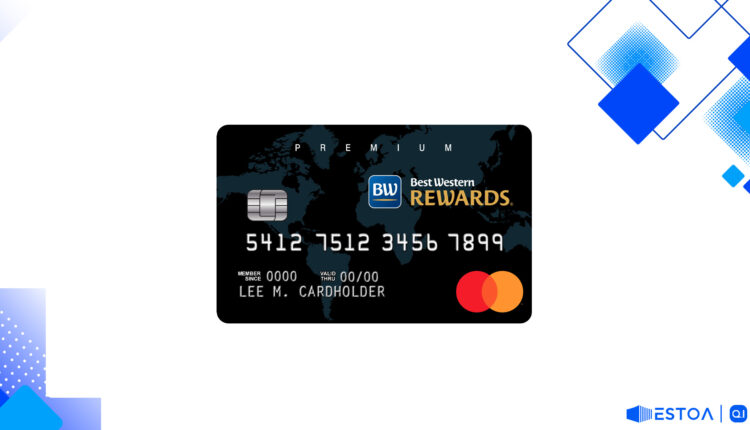

Earn Big with Best Western Rewards Premium Mastercard

Unlock High Rewards and Exclusive Perks with Best Western’s Top Credit Card

Best Western Rewards Premium Mastercard Review: Earn Big with Best Western Rewards Premium Mastercard

Unlock High Rewards and Exclusive Perks with Best Western’s Top Credit Card

Finding a credit card that brilliantly balances affordability and rewards can often feel like searching for a needle in a haystack. However, the Best Western Rewards Premium Mastercard seeks to redefine this equation, offering stunning benefits for just a modest annual fee. If you frequent Best Western hotels or plan to indulge in travel more often, this card could be your ticket to maximizing your rewards and experiences.

High Rewards and Robust Features

As a Best Western credit card, the Best Western Rewards Premium Mastercard stands out in the crowded travel rewards card market by offering a compelling suite of benefits and perks. Cardholders can earn up to 20x points on Best Western purchases and 2x points on all other transactions, leveraging the card's high rewards rates to amass points rapidly. Coupled with an attractive sign-up offer, this card ensures you are always a step ahead in collecting valuable points.

Attractive Sign-Up Bonus

Among the many perks, an eye-catching sign-up bonus is surely one of the best parts. New cardholders can earn up to 120,000 Best Western points, which translates into up to seven free nights at participating hotels. This bonus is awarded in two steps: 80,000 points after spending $3,000 in the first three billing cycles and an additional 40,000 points for spending $5,000 over twelve billing cycles. This structure encourages and rewards consistent use of the card.

Automatic Platinum Elite Status

Another noteworthy feature is the automatic Platinum Elite status. For loyal Best Western customers, this status offers value through perks such as 15% bonus points on stays, an exclusive reservation line, and no blackout dates. This level of automatic elite status can significantly enhance your travel experience with added convenience and luxury.

Rates, Fees, and Costs

With an annual fee of $89, the Best Western Rewards Premium Mastercard is competitively priced. Here's a deeper dive into the financial aspects of the card:

- Annual Fee: $89

- Ongoing APR: Variable APR between 23.24%-29.74%

- Foreign Transaction Fees: None

- Balance Transfer Fee: 5% of the transferred amount or $10, whichever is greater

For those who want a card with a robust rewards structure without hefty annual costs, this card presents an appealing option. The absence of foreign transaction fees further sweetens the deal for international travelers.

Elevated Rewards on Every Purchase

Many travel rewards cards restrict their high points earnings to specific categories, but the Best Western Rewards Premium Mastercard offers versatility. The card earns 10 points per dollar spent on Best Western stays, in addition to the 10 base points as a member of the Best Western Rewards loyalty program. All other purchases earn 2 points per dollar, making it a practical card for daily use.

Comparisons and Alternatives

While the Best Western Rewards Premium Mastercard holds its ground well, it's important to understand how it compares to other cards:

- Chase Sapphire Preferred® Card: This card offers more flexible rewards that can be transferred to a variety of travel partners. However, it comes with a higher annual fee of $95.

- IHG One Rewards Premier Credit Card: Similar in annual fee, this card offers a free anniversary night each year without requiring a spend threshold, which some users may find more straightforward and valuable.

Comparing these options can help you decide whether the Best Western focus fits your travel habits or if a more flexible card would serve you better.

Ongoing Perks and Benefits

High Point Value: Points earned with the Best Western Rewards Premium Mastercard can be redeemed for a range of rewards, including free hotel nights, gift cards, and more. To maximize the value of your points, aiming for redemptions that offer around 0.7 cents per point is advisable.

Earn Hotel Points Fast: This high rewards credit card is designed to help you earn hotel points quickly, with generous earnings on both Best Western stays and everyday purchases. The opportunity to earn up to 120,000 bonus points in the first year alone highlights its potential for substantial rewards accumulation.

Pros and Cons: A Balanced View

Pros:

- High rewards rate on purchases

- Generous sign-up bonus

- Automatic Platinum Elite status

- No foreign transaction fees

Cons:

- Annual fee of $89

- No automatic free anniversary night

- Limited rewards flexibility

| Feature | Best Western Rewards Premium Mastercard | Competitor Alternatives | |———————————-|—————————————–|———————————–| | Annual Fee | $89 | $0 to $95 | | Sign-Up Bonus | Up to 120,000 points | Up to 60,000 points | | Rewards Rate | 2x-20x points | 1x-3x points | | Automatic Platinum Elite Status | Yes | Varies | | Foreign Transaction Fees | None | Usually 0%-3% |

Is It the Right Fit for You?

Whether you frequently stay at Best Western properties or are considering this card for the lucrative travel rewards, the Best Western Rewards Premium Mastercard presents an impressive list of benefits. The automatic Platinum status, high rewards rate, and generous sign-up bonus make it a strong contender for those seeking a specific hotel rewards card.

However, if you're seeking more flexibility in how you use your points or prefer a card without an annual fee, exploring general travel cards might be more beneficial. Cards like the Chase Sapphire Preferred® or IHG One Rewards Premier Card offer more versatility with comparable annual fees.

Final Thoughts

The Best Western Rewards Premium Mastercard is a solid choice for travelers loyal to the Best Western brand. With its comprehensive rewards structure and valuable perks, it offers more than what many general travel cards provide. Whether you are embarking on frequent business trips or planning memorable vacations, this card ensures that every dollar spent brings you closer to your travel goals, all while enjoying the privileges that come with elite status.

Maximizing Your Best Western Points

To get the most out of your Best Western points, it's important to understand the optimal ways to redeem them. While free hotel nights are the most popular option, your points can also be used for gift cards, airline miles, and even charitable donations. However, the highest value typically comes from redeeming for hotel stays, particularly during peak travel seasons when room rates are higher. By planning your redemptions strategically, you can stretch your points further and enjoy more memorable experiences.

Points can also be used for room upgrades, giving you access to more luxurious accommodations without additional out-of-pocket expenses. Consider using points for international stays as well, where you might find greater value in destinations where nightly rates are generally higher. For those who prefer a hassle-free approach, the Best Western Rewards Premium Mastercard makes it simple to accumulate and redeem points efficiently.

Exploring the Rewards Program

The Best Western loyalty program is designed to offer more than just free nights. Members can enjoy exclusive benefits such as early check-in, late check-out, and even complimentary breakfast at some locations. These perks enhance the overall travel experience, making it more convenient and enjoyable. By consistently using the Best Western Rewards Premium Mastercard, you can quickly ascend the loyalty tiers, unlocking even more benefits and saving money on your travels.

Active participation in the Best Western loyalty program means you’ll be the first to know about promotions, sales, and special offers. This can include earning double or triple points during certain periods, or gaining access to limited-time discounts on bookings. Staying informed about these opportunities allows you to further maximize the value of your rewards and stretch your travel budget.

Final Considerations for the Best Western Rewards Premium Mastercard

While the Best Western Rewards Premium Mastercard is certainly an excellent choice for loyal Best Western customers, it's always wise to consider your overall travel and spending habits. If your travel routines include a variety of hotel brands or you're looking for more diverse spending rewards, you might need to evaluate whether another travel rewards card would better suit your needs. Cards like the American Express® Gold Card or the Capital One Venture Rewards Credit Card offer flexible points systems that can be advantageous for travelers with wide-ranging preferences.

Ultimately, if Best Western properties are your go-to choice for accommodations and you value the perks associated with elite status, this card can significantly enhance your travel experiences. With the combination of high rewards, vibrant benefits, and a manageable annual fee, the Best Western Rewards Premium Mastercard represents a unique opportunity to elevate your travel game. Yet, for those still exploring options, there’s another card that might catch your interest. Discover a completely different travel card that offers unique advantages tailored to diverse travel styles – your journey to the perfect card might just continue here.