CommBank Low Rate Credit Card: Ultimate Savings and Security in One Package

Reviewing Australia’s Finest Credit Card Offers with 0% Interest, Cashback, and App Control

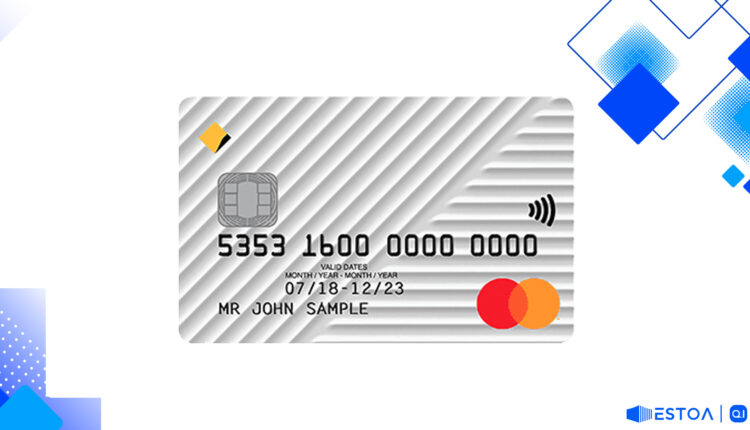

Imagine a credit card that offers unbeatable savings coupled with advanced security features, all in a budget-friendly package. The CommBank Low Rate Credit Card is exactly that, promising to revolutionise how Australians manage their expenses. With a compelling mix of low rates, cashback offers, and app-controlled security, it's designed to appeal to savvy spenders and prudent planners alike.

Key Features of the CommBank Low Rate Credit Card

When considering a new credit card, it's essential to understand the main features, fees, and potential benefits. The CommBank Low Rate Credit Card brings a lot to the table for those looking for affordability and functionality.

Low-Rate Benefits

First and foremost, this card offers a 0% p.a. interest rate on purchases for the first three months. This introductory offer is an excellent opportunity for anyone planning to make big purchases soon. Whether it's furnishing a new home or booking a holiday, this feature allows you to spread the cost without incurring interest.

Additionally, the Commonwealth Bank Low Rate Card has an annual fee of just $72, making it a low annual fee credit card. This fee is very competitive for the Australian market, letting you enjoy the benefits of a credit card without breaking the bank.

Cashback and Introductory Offers

Everyone loves cashback, and the CommBank credit card does not disappoint. You'll get up to $240 cashback, provided you meet the spending requirement within a specified period. This feature turns everyday expenses into a rewarding experience, making this card perfect for those who want to make their money work for them.

Security Features

In today's digital age, security is paramount. One of the standout features of the CommBank Low Rate Credit Card is its lock, block, or limit transaction functionality. Through the CommBank app or NetBank, you can easily manage your card's security. Whether you want to block certain types of transactions or set spending limits, this card provides a robust level of control.

Costs and Benefits

Understanding the costs and benefits is crucial when choosing a credit card.

| Feature | Details | | ——– | ——— | | Annual Fee | $72 | | Introductory Interest Rate | 0% p.a. on purchases for the first 3 months | | Standard Interest Rate | Competitive low rate | | Cashback | Up to $240 | | Security Features | Lock, block, or limit transactions via app or NetBank | | Control Features | App and NetBank access |

How to Apply for the CommBank Low Rate Credit Card

Applying for the CommBank Low Rate Credit Card is straightforward. You'll need to visit the Commonwealth Bank's official website or use the CommBank app. The application process involves filling out personal details, employment information, and financial status. Once submitted, you typically receive a decision within minutes.

Pros and Cons

Having a balanced view of the pros and cons will help you make an informed decision.

| Pros | Cons | | —- | —- | | 0% interest on purchases for the first 3 months | Cashback eligibility requires meeting spending criteria | | Low annual fee | Introductory offers are time-bound | | Up to $240 cashback | Limited cashback period | | Advanced security features | Potential fees for late payments | | App and NetBank control | |

Why Choose the CommBank Low Rate Credit Card?

Choosing the right credit card involves aligning its features with your needs. The CommBank Low Rate Credit Card stands out due to its balance of affordability, security, and enticing introductory offers.

Best Use Cases

This credit card is particularly useful in scenarios where you need to manage large expenses or make significant purchases without incurring hefty interest charges. The 0% interest for the first three months is ideal for this purpose. Likewise, frequent spenders will benefit from the cashback offer, turning routine costs into tangible rewards.

Managing Your Card Through the App

The CommBank app and NetBank provide unparalleled control over your credit card. From monitoring transactions to setting up alerts and limits, managing your finances has never been easier or more secure. This feature is a significant benefit for those who prioritise security and control.

Maximising Cashback Benefits

To make the most out of the cashback offer, plan your expenditures during the introductory period. Large purchases made within this timeframe can yield significant cashback, effectively reducing your total spend.

Conclusion

The CommBank Low Rate Credit Card is an excellent option for anyone looking to manage expenses smartly and securely. Its low annual fee and introductory offers make it a budget-friendly choice, while app-controlled features provide added peace of mind. Whether you're planning big purchases or looking for the best credit card deals in Australia, this card ticks all the right boxes.

The CommBank Low Rate Credit Card stands out as a top pick for those seeking value without compromising on security. Don't miss out on an opportunity to combine affordability with comprehensive features.

Advanced Features for Smart Spending

One often overlooked but highly beneficial aspect of the CommBank Low Rate Credit Card is its suite of advanced features designed to optimize your spending habits. Through the CommBank app, users can access spending insights that categorize your expenses, helping you identify areas where you can cut costs or reallocate your budget. This feature not only aids in financial planning but also makes it easier to meet the criteria for cashback rewards. For instance, recognizing which categories you spend most on can help you strategize better, ensuring you hit the required spend to maximize your cashback benefits.

Additionally, the CommBank Low Rate Credit Card offers exclusive access to Commonwealth Bank's extensive network of partners, providing cardholders with a multitude of deals and discounts. Whether it's shopping, dining, or travel, these exclusive offers add an extra layer of value to your everyday spending. Utilizing these offers can stretch your dollar further, making it easier to enjoy a more luxurious lifestyle without the premium price tag. By integrating these features into your regular financial routine, you're not just saving money but also enhancing your overall financial well-being.

Leveraging Security Features

In an era where cyber threats are ever-evolving, the CommBank Low Rate Credit Card’s security features offer unparalleled peace of mind. Beyond the basic blocking and limit-setting options, the card also integrates advanced fraud detection algorithms. These algorithms monitor your spending patterns and alert you instantly of any unusual activity, allowing you to react swiftly and prevent potential fraud. The CommBank app’s real-time notifications are essential for those who want to stay on top of their account’s security at all times. This feature is particularly beneficial for frequent travelers who may be more susceptible to fraud due to varied spending locations.

The card also supports digital wallets like Apple Pay and Google Pay, adding another layer of security through biometric authentication. Instead of entering your card details manually, you can simply use your fingerprint or facial recognition to make payments, reducing the risk of your card information being stolen. With these multi-layered security measures, you can focus on enjoying the benefits of your CommBank Low Rate Credit Card without constantly worrying about security threats.

Long-Term Benefits and Financial Planning

While the immediate perks of the CommBank Low Rate Credit Card are undoubtedly appealing, its long-term benefits should not be underestimated. One of the key advantages is the low ongoing interest rate, which makes it easier to manage your finances over an extended period. This is particularly useful for individuals who may occasionally carry a balance but wish to minimize interest payments. Additionally, the autonomy provided by the app allows for better financial oversight, enabling you to set spending limits and alerts that align with your long-term financial goals.

The comprehensive report summary available through NetBank also plays a crucial role in financial planning. You can download detailed monthly statements that provide a transparent view of your expenses, helping you to adjust your budget as needed. For those who are planning significant financial milestones, such as buying a house or funding their education, this clarity can be immensely beneficial. By consistently leveraging these tools, you'll find it easier to maintain financial discipline, avoid debt traps, and ultimately achieve greater financial stability.

Curious about exploring another option that offers unique features tailored to different needs? Keep reading to discover an alternative credit card that could be the perfect fit for you.