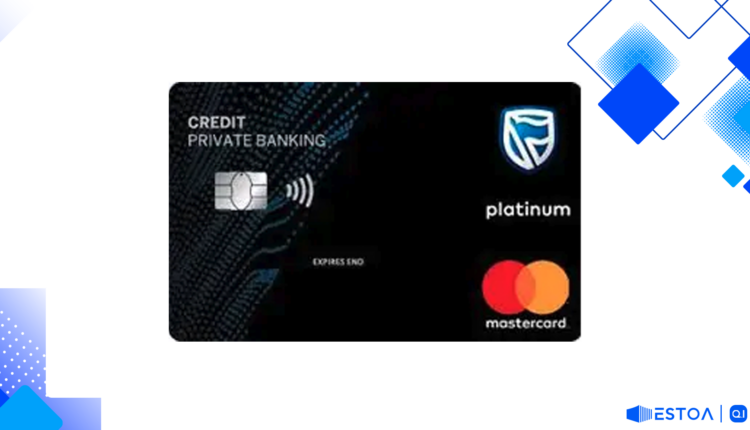

Standard Bank Platinum Credit Card: Unmatched Lifestyle and Travel Perks in South Africa

TÍTULO CORRIGIDO: “The Standard Bank Platinum Credit Card Redefines Premium Banking”

SUBTÍTULO CORRIGIDO: “Exclusive Benefits and High Credit Limits Feature the Offering”

Discover unparalleled lifestyle and travel perks with the Standard Bank Platinum Credit Card, a leader among premium credit cards in South Africa. Designed for high-income earners with refined tastes, this high limit credit card redefines luxury banking through exceptional benefits tailored to your needs. Let's dive into what makes the Standard Bank Platinum Credit Card stand out among the best credit cards South Africa has to offer.

Overview of the Standard Bank Platinum Credit Card

The Standard Bank Platinum Credit Card is not just any credit card; it's a private banking credit card that includes a dedicated private banker and access to financial advisors at no extra cost. This personalised interest credit card is perfect for individuals with high expenditure, offering a range of lifestyle and travel benefits.

Key Features:

- Monthly Service Fee: R94.00

- Minimum Monthly Income Requirement: R58,000.00

- Maximum Credit Limit: R250,000.00

- Minimum Monthly Payment: 3% of outstanding balance

- Initiation Fee: R180.00

The interest rate is personalised and can be as low as the prime rate, with the maximum being the repo rate plus 14%. Opt for zero interest by paying your outstanding balance in full each month.

Travel and Lifestyle Benefits

Your Standard Bank Platinum Credit Card offers an array of exclusive credit card features designed to enhance your lifestyle and travel experiences.

Travel Benefits:

- Up to 35% off on Emirates flights when booked through Leisure Desk.

- 10% off Health Spa treatments and hotel accommodations through selected partners.

- Automatic basic travel insurance up to R1,000,000.00 when travel tickets are purchased with your card.

- Up to 33% off purchases when you shop online at ‘Wine of the Month’.

Lifestyle Rewards:

- Up to 35% off at selected stores.

- Up to 20% off trips in the Middle East and Africa using the Careem cab-hailing app.

- Discounts at retailers like Hirsch’s and Avis.

Exclusive Perks and Insurance Benefits

More than just discounts and rewards, the Standard Bank Platinum Credit Card offers significant insurance benefits and exclusive perks.

Insurance Benefits:

- Basic travel insurance up to R1,000,000.00 for travelers under 75.

- Optional credit card protection plan to cover debt in case of unforeseen events.

Exclusive Features:

- Access to Café Blue lounges at OR Tambo and Bidvest Lounges.

- Security features for online and in-store purchases, including automatic lost card protection.

- UCount Rewards for every transaction.

Comprehensive Fee Structure

Here’s a detailed look at the fee structure for the Standard Bank Platinum Credit Card:

- Monthly Service Fee: R94.00

- Initiation Fee: R180.00

- International Transaction Fee: 2.50%

- Cash Withdrawals at Standard Bank ATM: R7.50 per R1,000.00

- Branch Cash Withdrawals: R20.00 per R1,000.00

- Online Account Payments Fee: R9.00

- Point of Sale Cashback Fee: R1.40 per R100.00

While the card does come with various transaction fees, its array of benefits and high credit limits make it a worthwhile consideration for high-income earners.

Pros and Cons

| Advantages | Disadvantages | |————|—————-| | Up to 35% in discounts on Emirates flights | High international transaction fees | | Access to Cafè Blue lounges | Multiple transaction fees for frequent users | | Automatic travel insurance and lost card protection | High branch transaction fees |

How to Apply for the Standard Bank Platinum Credit Card

Interested in enjoying the best that premium credit cards have to offer in South Africa? Here are the qualifying criteria:

Eligibility Requirements:

- Minimum monthly income: R58,000.00

- Must be over 18 years old at the time of application

- South African ID or passport for non-citizens

- Recent payslip and 3-month bank statement

- Proof of residence not older than 3 months

Why Choose the Standard Bank Platinum Credit Card?

The Standard Bank Platinum Credit Card is ideal for professionals and high-income earners who seek comprehensive private banking benefits and exclusive perks. It offers remarkable travel and lifestyle rewards, personalised interest rates, and substantial insurance benefits, making it one of the best credit card offers in South Africa.

For those who manage substantial expenditure, access to a dedicated private banker and financial advisors can elevate your financial management to professional levels, helping you make informed decisions.

Experience the ultimate in luxury credit card benefits and redefine your premium banking experience with the Standard Bank Platinum Credit Card.

Financial Flexibility and Management

One of the most compelling reasons to opt for the Standard Bank Platinum Credit Card is its incredible financial flexibility and management tools. This high-income credit card offers users personalised financial advice, helping you to make better-informed decisions regarding your spending habits, investments, and savings. By leveraging the expertise of dedicated financial advisors, you can tailor your financial strategy to meet your unique needs and goals. This feature sets it apart from many other premium credit cards, which often do not offer such personalised support. Whether you're looking to invest in real estate, stocks, or other ventures, the insights you gain here can be invaluable.

The card also comes with sophisticated budgeting tools available through Standard Bank’s online portal and mobile app. These tools help you to track spending, set financial goals, and receive alerts for due dates and payment reminders, keeping you on top of your financial health. Additionally, its high limit credit card feature ensures that you have ample spending power without the constant worry of hitting your credit limit. This is particularly useful for high-net-worth individuals who require a credit card that can keep up with their lifestyle and spending needs.

Maximise Your Rewards and Discounts

When it comes to rewards, the Standard Bank Platinum Credit Card truly excels. Cardholders can benefit from a variety of credit card rewards South Africa has to offer, including the UCount Rewards program. This program allows you to earn points on every purchase, which can then be redeemed for a wide range of products and services, from travel bookings to home appliances. The rewards system is designed to incentivise smart spending, making it easier to accumulate points faster and enjoy substantial savings.

Moreover, one of the standout features of this card is the impressive array of discounts available. From up to 35% off on Emirates flights to discounts at elite retailers and luxury hotels, the value-adds can significantly offset the annual fees and other costs. Plus, regular promotions offer opportunities for additional savings, enhancing the overall value proposition of this exclusive credit card. When you consider the comprehensive list of discounts with the credit card, it becomes evident that this card is not just a payment tool but a strategic financial asset.

Your Next Step Towards Unmatched Benefits

By now, it’s clear that the Standard Bank Platinum Credit Card offers a remarkable blend of lifestyle benefits, travel perks, and personalised financial management tools. But what if you’re looking for something a bit different? Perhaps a card that offers unique rewards catering to another aspect of your lifestyle? There is an array of high-end credit cards available that provide specialised perks tailored to distinctive needs.

Ready to explore another path in premium banking? Discover an alternative that promises to redefine your expectations with features you never knew you needed. Take the next step in your financial journey and unlock another world of possibilities today.